Takeaways:

- Governor wants recommendations from agencies by January 30

- Agencies will consider limiting utilities' exposure to wildfire damage claims

- Consumer advocate criticizes possible public subsidy of insurance

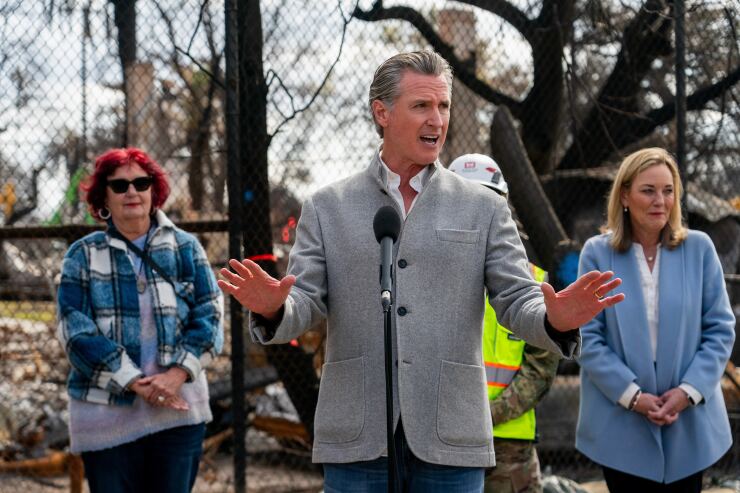

California Governor Gavin Newsom's

The order, issued September 30, assigns state agencies including the California Department of Insurance (CDI) to produce recommendations for the state's Wildfire Fund Administrator by January 30. The fund pays claims for damages from wildfires caused by utilities.

The order also tasks CDI to provide information and recommendations on the accessibility and affordability of property insurance, ways to socialize the risk of wildfire damages and compensate those affected, set wildfire mitigation measures, expedite compensation for wildfire damage, start programs to reduce wildfire risk and set minimum insurance requirements.

The order's provision on litigation assigns CDI with the state's Department of Forestry and Fire Protection, and Public Utilities Commission, to analyze the benefits and impacts of limiting litigation damages from wildfire ignitions caused by utilities.

"We commend the Governor for recognizing that the climate related property insurance crisis is impacting or will soon impact virtually all California home and business owners and all the state agencies with jurisdiction over public safety and health, housing, employers, real estate, lenders, renters, vulnerable households," stated Amy Bach, executive director of United Policyholders, in an email response to questions.

Ryan Mellino, staff attorney at Consumer Watchdog, stated in an email response that the risk of damage from natural catastrophes should not be socialized. "In the name of profit, insurance companies have played an integral role in enabling the harmful environmental impacts we all now face by underwriting fossil fuels and other environmentally damaging industries," he wrote. "Such companies should also bear primary responsibility for redressing the harms they have enabled, rather than being permitted to foist the consequences onto all Californians."

Consumer Watchdog agrees with the governor's "whole of government" response, Mellino stated, but added that the