Insurers are embracing the benefits of cloud – elasticity, increased stability, and rapid deployment, to name a few – and over 70% of carriers use some cloud today.

Even so, the transition to cloud inevitably changes an organization’s daily business. As carriers ready their organizations for a cloud-enabled future, they’ll need to consider the potential impact of cloud migration across a few areas:

- Financial Implications. Cloud infrastructure often requires the CIO to partner with the CFO. Carriers should consider how to shift from CapEx to OpEx, account for new development methodologies like Agile, and determine which pieces of on-site infrastructure to retain.

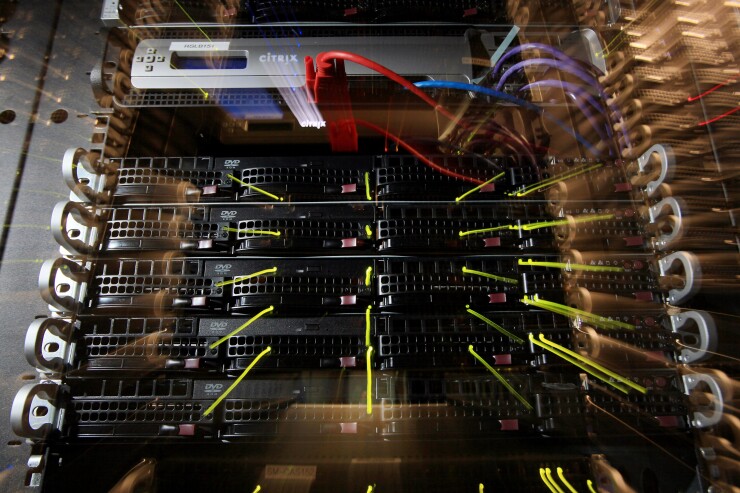

- Architectural Preparedness. On-premise data centers have allowed organizations to subsist on less efficient and higher-risk manual processes. On-site infrastructures allowed workarounds but moving to the cloud requires technology architecture best practices.

- Human Considerations. The shift to cloud infrastructure will require CIOs to develop alliances across the enterprise and to build trust within the IT organization.

Carriers will likely support a hybrid mix of cloud and on-premise applications in the near-term as they prepare their organizations for future cloud adoption. Like any new technology, cloud migration presents challenges, but each step towards a mature cloud practice will mean improvements to speed, flexibility, and capacity.

For more on best practices for insurers looking to migrate their infrastructure and applications to the cloud, see Novarica’s latest brief,