Though policyholders are typically satisfied with how their auto insurers handle their claims, customers are still reticent to use digital first notice of loss capabilities in kicking off the process.

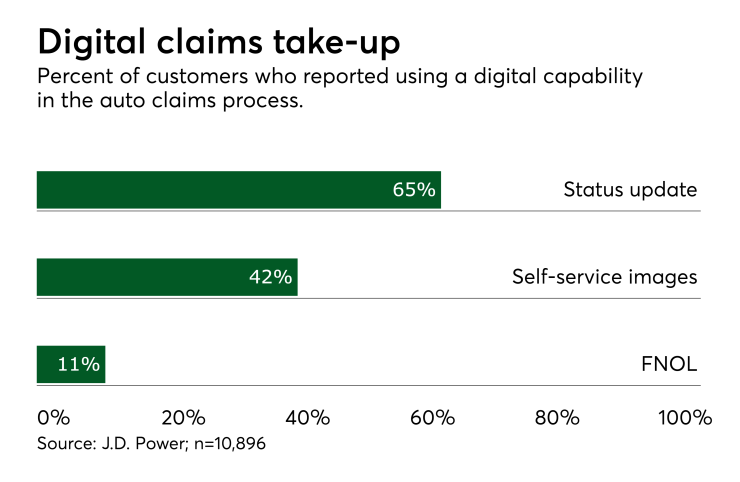

That's according to J.D. Power & Associates' 2018 U.S. Auto Claims Satisfaction Study, which surveyed 10,896 consumers. The report finds that 11% of claimants filed their first notice of loss digitally, only a slight increase from last year's 9%.

The continuing trend presents a quandary for insurers that are investing in digitalization at a high level but find customer behavior at the time of claim not lining up. David Pieffer, P&C practice lead for J.D. Power, says that the relatively low interaction frequency between insurer and insured, plus the urgency and anxiety around claims, make it hard to transition customers to a new channel.

“The challenge for insurers is to seamlessly transition the claims reporting function to more cost-effective digital customer care solutions," he says. "For many insurance customers, reporting a claim is one of the few direct interactions they have with their insurer and it comes at a time when they are looking for a reassuring voice. That’s not the ideal time to introduce a new digital touch point.”

At the same time, customers do make heavy use of digital capabilities at other points in the process: 65% recieved digital status updates, and 42% submitted their own pictures for estimating purposes through mobile apps. Satisfaction increases when insurers use self-submitted images and videos for estimating, J.D. Power found, but it dropped when digital FNOL is used, indicating that customers want to kick off claims with a human being, but manage it digitally.

J.D. Power isn't currently tracking chatbot use in claims for FNOL, Pieffer tells Digital Insurance. Considering the reticence customers have toward using any digital FNOL capability, he explains, that doesn't seem to be the best application for the technology.

"Using a chatbot is a potential way to offer an electronic “hug” or reassuring voice, but I don’t think the industry [or] customers are quite there yet, [especially] if they know they are not talking to a live person," he says. "I think video chat might be the next step before we go to a fully automated chat function, but that is my opinion based on an overall view of the industry."

On J.D. Power's 1,000-point scale, overall satisfaction levels rose to 861 on average, a three-point jump from 2017. The spread between the highest-ranked and lowest-ranked insurer has shrunk to 70 points, the company also report. The top four insurers were Erie (891), Amica (887), Auto-Owners (882) and Farmers (874).