Not so long ago, insurance was a slow moving industry influenced primarily by tight regulation and an agent-driven distribution channel. But it is not your imagination: the rate of digital change is accelerating. As the Internet began to change everything from ordering a pizza to paying bills, insurers changed the speed at which they offered products and consumers fundamentally changed their expectations for what digital interactions should look and feel like. The proliferation of smart devices threw gasoline on this fire, creating an entirely new digital insurance ecosystem.

That frantic pace has yet to abate. Digital insurance capabilities continue to advance. The pressure faced by top carriers to constantly evolve is only increased by nimble leaders outside the insurance industry like Amazon or Netflix, which consistently raise an already high-bar for digital interactions.

Unfortunately, while the industry continues to make upgrades in terms of their digital capabilities, most insurers are actually falling further behind in the high-stakes battle to meet customer expectations. Indeed, in a new study that tracks the digital experience of P&C insurance customers, J.D. Power and Centric Digital find that the insurance industry lags far beyond many other service industries when it comes to delivering a truly engaging, impactful digital customer experience.

So how can carriers respond to keep pace with consumers’ constantly evolving digital expectations?

Drawing on the results of our 2018 Digital Experience Study, released today, J.D. Power and Centric Digital have highlighted some of the top challenges currently confronting the industry, and highlighted examples where top performers are starting to establish a set of digital best practices.

1. Focus on Digital Proficiency in Customer Service

The modern customer experience is heavily driven and supported by a firm’s digital ecosystem, even in relationship-based industries. To create an elegant experience, insurers should use digital to connect their customer touch points to create a frictionless, personalized focused on the specific, contextualized needs of a consumer.

The strength and weaknesses of an insurer’s digital capabilities are evident in the satisfaction and loyalty of their customers. A poor experience makes customer retention less likely and a negative reputation more likely, as seen by the correlation between the customer experience scores and customer satisfaction illustrated in our study. One might expect this to spur insurance companies to emphasize digital best practices. Unfortunately, this is not always the case. Overcoming a negative reputation is certainly a tough chore and can lead to capital better spent elsewhere tied up re-engaging with a small subset of customers.

The study found that most digital content for insurance brands is well-maintained, relevant, and helpful in basic digital capabilities on a 1,000-point scale, qualities like site organization, branding, and responsiveness scored 947, 905, and 895, respectively. However, they often lack the functionality of more modern digital interactions.

So, while insurance companies have the basics down, insurers continue to lag other industries in terms of digital performance. With an increasingly competitive insurance marketplace influenced by empowered consumers, carriers must do a better job in digital customer service if they expect to remain competitive in the long-term.

2. Personalization Key to Digital Adoption

Insurers are falling short in terms of providing customers with relevant and personalized digital experiences. According to the study, 42% of insurers do not meet best practices related to digital cross-channel personalization. This may include knowing the customer across channels, tailoring products and offerings to meet their unique needs, and anticipating what potential customers may need and want.

Relevancy of information is key. Consumers are bombarded with constant messaging, most of which is off target. Personalization that delivers the most useful content or experience at a customer's moment of need promises to address this issue – but it must be used correctly.

Carriers should begin by improving personalization within a few product lines or segments and then shift focus on digital to help scale across all customer interactions. They should also view digital capabilities as a core focus of customer service and interaction, rather than as more of a support to general business functions.

3. Deliver More Consistency Across Digital Experiences

Each customer wants to interact with a brand in a different way. It is important to allow customers to communicate and interact through the channel they prefer.

Our study found that, among shoppers who wished to contact the insurer during the quoting process, over half of them wanted contact by some method other than phone, including chat, mobile, and website. Further, consumers expect those interactions to be seamless across channels, so that an interaction with an agent should be updated to their online profiles soon after completion.

Failure to meet these expectations has already opened the door to insurtech disrupters. Consider Lemonade, the property and casualty insurance company offering renters and home insurance policies, which employs “Maya,” an artificial intelligence bot. The firm leverages chat functionality when quoting and enrolling customers to simplify onboarding and aims to maintain this improved experience across all channels. While currently unique to Lemonade, this process is increasingly typical of what customers expect. Expect other insurers to meet the demand sooner rather than later.

Having a consistent omnichannel experience to represent a brand has never been more important for insurers, even for those with “direct” business models. Yet 38% of the categories assessed in our study registered at parity or below for digital proficiency. Inconsistency erodes brand quality, customer stickiness, and consumer loyalty -- three key factors that define longevity of relationships with policyholders.

Customers expect a seamless omnichannel experience, but few insurers are getting it right. Insurance companies must ensure they’re providing easy access to customer service across channels when needed—whether the policyholder is at a location, scrolling through an app, or browsing the website. Continuity of experience goes beyond putting the customer service phone number in bold font. Whether maintaining a clear connection within and between your 1-800 number, live agent chat windows, or online self-help libraries, it’s about consistent communication with customers in a way that meets their needs.

4. Improve Digital Optimization with Recognizability

Our study found 50% of insurance brands below parity level in digital channel proficiency, suggesting that even companies already heavily invested in digital, like direct-to-consumer leaders, have left behind digitally enabling communication. Experience and channels currently undeveloped include immersive mobile app capabilities, seamless omnichannel experience, presenting a single visual style to customers, and more efficient chat.

Take, for example, chat and chatbots, a great technology option for companies to augment traditional communication channels. Leveraging artificial intelligence, insurers can employ a digital customer service representative to guide policyholders to necessary information, then pass customers to a live representative if all alternatives have been exhausted. The result is a more cost-effective, streamlined customer service experience. Yet despite the clear return on investment, only 74% of the insurance we evaluated have basic webchat.

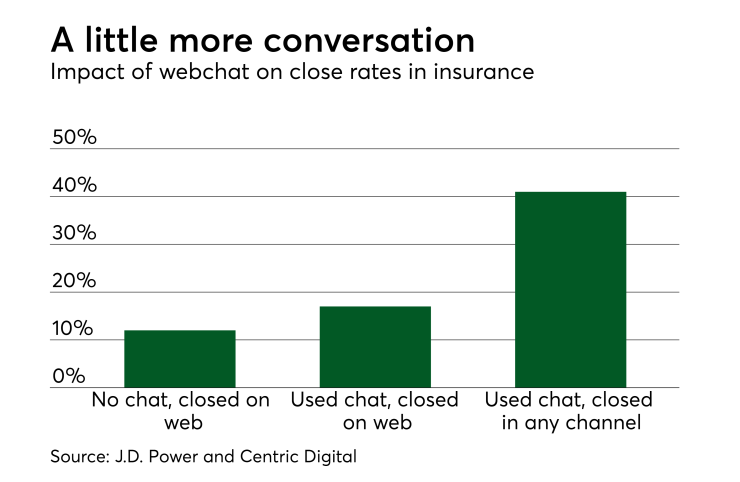

Also consider the missed growth opportunities. Prospective customers using chat when obtaining a quote were more likely to buy online than those who obtained quotes online but did not use live chat (17% vs. 12%, respectively).

5. Include Digital Best Practice Benchmarks from Outside the Insurance Industry

Hari Gopalkrishnan, CIO of client-facing platforms at Bank of America, noted: “Our customers don’t benchmark us against banks. They benchmark us against Uber and Amazon.” No doubt he is right: consumers expect digital best practices across all brands and refuse to wait for a technology to pierce an industry before judging brands deficient.

A handful of digitally native firms drive consumer expectations, acclimate customers to changes, and cause individuals to integrate habits into their routines when they introduce new technologies or experiences. Brands that understand these expectations and adapt accordingly are winning in the minds of customers.

Look no further than Target, which recently merged its Cartwheel couponing and offer app into its full-service mobile app. The powerful nature of the two successful apps under one umbrella app made features that drove one app available to both experiences. It also allowed for the simultaneous introduction of Apple Watch integration, instead of leading with one app and leaving consumers dissatisfied with the other.

Conclusion

Stakes are high for insurance companies in the digital space. Firms can no longer look at digital in a vacuum and instead should put customer digital expectations driven by their competitors as well as digitally-skilled companies in other industries at the top of their minds. They must support their digital ecosystem with not only good design, but delivery of seamless experiences. Digital innovators that promise strong capabilities may be well‐positioned to fill the gap left by insurers that are slow to adopt digital capabilities. Data has shown that unmet consumer expectations are linked to satisfaction and, from there, directly to business success. Billions hang in the balance.