-

While several CEOs have been critical of this administration, they have flocked to the White House this week seeking to influence the government’s technology policies going forward.

June 23 -

Another industry alliance is forged aimed at providing driver data to insurance companies.

June 21 -

Demand for AI and information management talent is skyrocketing but filling those positions is proving tough, says Indeed.

June 19 -

Insurer has rolled out several initiatives aimed at a more modern experience during insurance's 'moment of truth.'

June 12 -

Expanding channels and integrating with emerging data sources are increasingly important drivers of major IT projects, says SMA.

June 7 -

Carrier experts discuss keys to creating a data-driven culture and improving customer experience at IASA conference.

June 7 -

Enterprise-wide digital transformation efforts are putting information at greater risk for compromise.

June 2 -

Use cases range from risk modeling to fraud detection, says study.

June 1 -

To realize the benefits of emerging tech, insurers need to take big swings at SaaS rather than sticking to ancillary functions.

May 31 Speer Content Strategy & Development

Speer Content Strategy & Development -

New tech companies are shaking up the insurance market with Internet of Things, drone and machine learning products.

May 26 -

Here’s how insurers can move important analytics projects from innovation to production.

May 26 CIO Study Group

CIO Study Group -

This shift is impacting the entire IT channel, including vendors, distributors and solution providers, says CompTIA's Carolyn April.

May 25 -

Nearly half of organizations surveyed said hosting big data was a major factor in a cloud-first strategy, explains Mark Clayman.

May 24 -

The cyberattack that infected hundreds of thousands of computers worldwide is likely to have originated with a hacking group linked to the reclusive state.

May 23 -

You can always spend more money to shore up data protection, but here's what else needs to be done.

May 22

-

The attackers have claimed only about $92,000 in payments from their widespread ransom demands.

May 19 -

Cyprus-based insurer deploys new platform for life, investment and health lines of business.

May 18 -

More than a third of customers prefer automated service via machine learning to alternatives, according to Celent report.

May 17 -

As companies around the world defend against the WannaCry ransomware attack, a new study finds basic defensive measures are often lacking.

May 17 -

CISO Tim Callahan outlines how insurers can beat phishing attacks with adequate preparation.

May 16 -

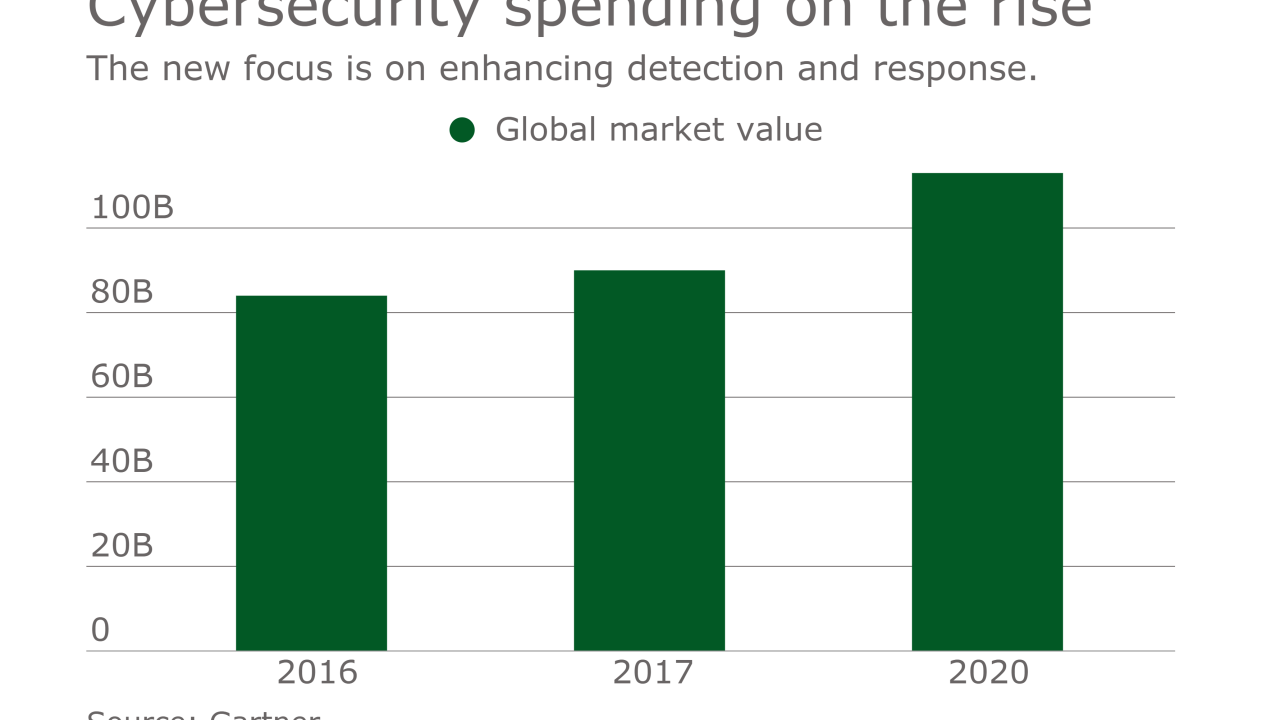

Even as computer attacks become more prevalent and damaging, they haven’t been a universal triumph for the data protection industry.

May 15 -

The malware used a technique purportedly stolen from the U.S. National Security Agency.

May 14 -

Jennifer Marshalek, SVP for the P&C carrier, provides tips for carriers to navigate the digital world.

May 11 -

The move supports the specialty insurer's ongoing digital strategy.

May 11 -

Insurer embraces self-service and analytics in revamped claims process.

May 8 -

More than one third of firms were attacked at least five times in past 12 months, says security expert Nat Kausik.

May 1 -

Entering the storm season, several large insurers have unmanned aerial-vehicle fleets ready to go.

May 1 -

Pricing has dropped by up to 14% annually as more organizations take their information to a crowded cloud environment.

April 27 -

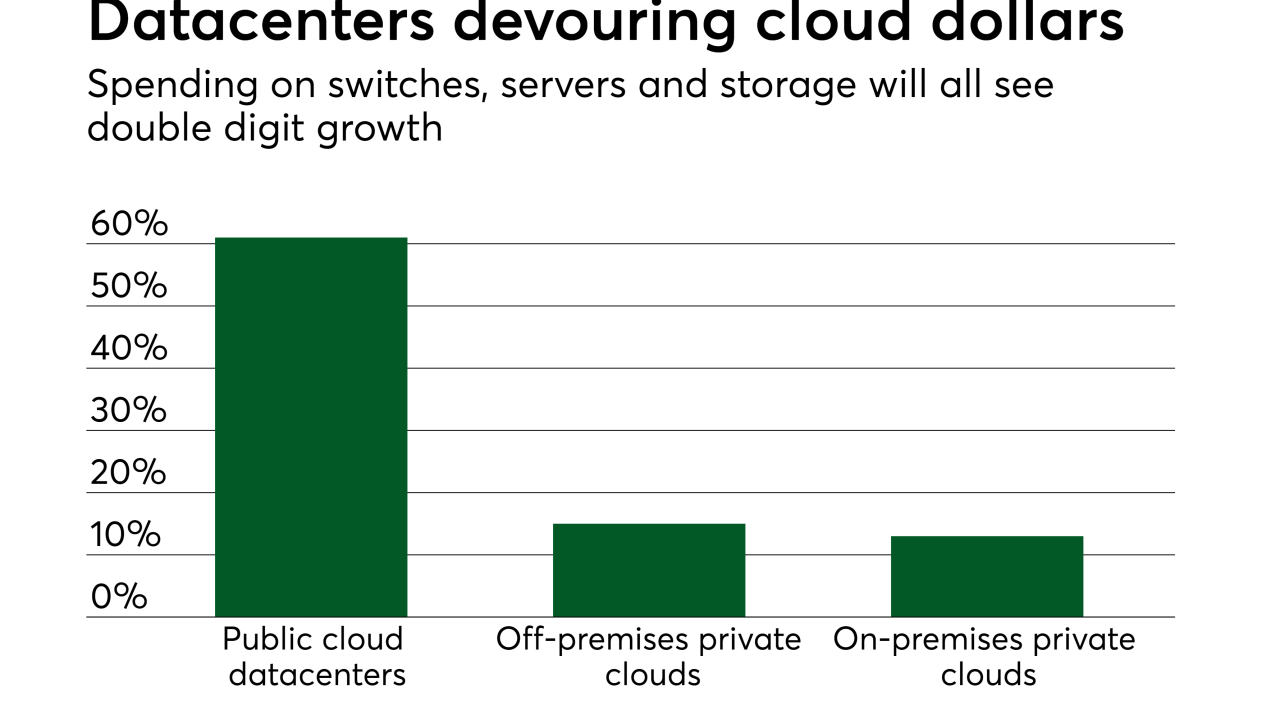

Public datacenters to do the majority of spending in 2017, according to new study.

April 26 -

Startup technology companies are upending the insurance industry with increased use of third-party data and new products that last shorter durations.

April 25 -

Analytics, cloud computing and security are among top skills employers seek.

April 25 -

Data and analytics initiatives, cloud implementations and insurtech partnerships and integrations will lead the way, according to Celent report.

April 20 -

If artificial intelligence efforts are to succeed they need to focus on solving real consumer needs, says Forrester analyst Jennifer Wise.

April 20 -

College students were tasked with building data visualization tools for underwriters to assess impacts of catastrophes.

April 17 -

Laxman Prakash assumes new role as second VP of information security at the life & annuity carrier.

April 14 -

Iowa insurer will integrate vendor's software with 17 policy administration systems.

April 13 -

The worldwide private and public cloud market grew by nine percent in 2016, as organizations increased spending on servers and networking equipment.

April 12 -

SMA research identifies a definite slowdown in the purchase of core systems in the P&C market.

April 12 Strategy Meets Action

Strategy Meets Action -

Data visualization, dashboards, data integration and data quality are among the features cited as most critical by firms.

April 11 -

Farmers' subsidiary begins new core instillation with its dwelling fire and specialty homeowners lines.

April 7 -

By 2020, 90% of organizations will adopt a data environment that has both cloud and on-premise computing services.

April 7 -

Carriers need guidance from outside the industry to truly get digitalization, says Munich Re exec.

April 5 -

The insurance business is changing, and all technology providers have something to contribute.

April 3

-

The Insurance Corporation of British Columbia completed an implementation of Guidewire's policy administration system.

March 31 -

Identity theft was the leading type of data breach last year, accounting for 59% of all privacy hacks.

March 30 -

Home and auto insurer adopts Duck Creek's AgencyPortal, Turnstile, and AgencyConnect technologies.

March 30 -

Nearly two-thirds of organizations experienced a “known” major cyber attack in the past 12 months, with the average being four.

March 23 -

The tech giant said it is enabling third parties to create financial services apps in the cloud.

March 21 -

Growing risks are often associated with improper sharing through mobile devices, study reveals.

March 17 -

The need is for EDR, software-defined segmentation, cloud security, and user and entity behavior analytics.

March 16 -

Committee members will work to keep regulators up to date on new products from startups and established insurance industry players.

March 13 -

Modernizing insurers' IT environments often leads to more reliable data that can facilitate improved processes.

March 13 PwC's FS Insurance Advisory Services

PwC's FS Insurance Advisory Services