-

Insured losses for so-called non-peak perils — also sometimes referred to as secondary perils — reached a record $98 billion last year, Munich Re said in a report released on Tuesday.

January 13 -

Swiss Re's Liability Excess Inflation report outlines the rising severity of liability claims, revealing a 7% growth in the United States during 2024.

January 12 -

AI impersonation fraud and attempts involving deepfakes have surged by more than 2100% over the last three years.

January 12 Input 1

Input 1 -

Kyle Busch's lawsuit against Pacific Life and his former insurance agent provides a window into potential issues around complexity, suitability and more in indexed universal life policies.

January 12 -

Digital Insurance contacted insurance professionals to comment on workers' compensation insurance.

January 11 -

Insurance carriers are working to improve digital quoting, according to the Keynova Q4 2025 Online Insurance Scorecard.

January 11 -

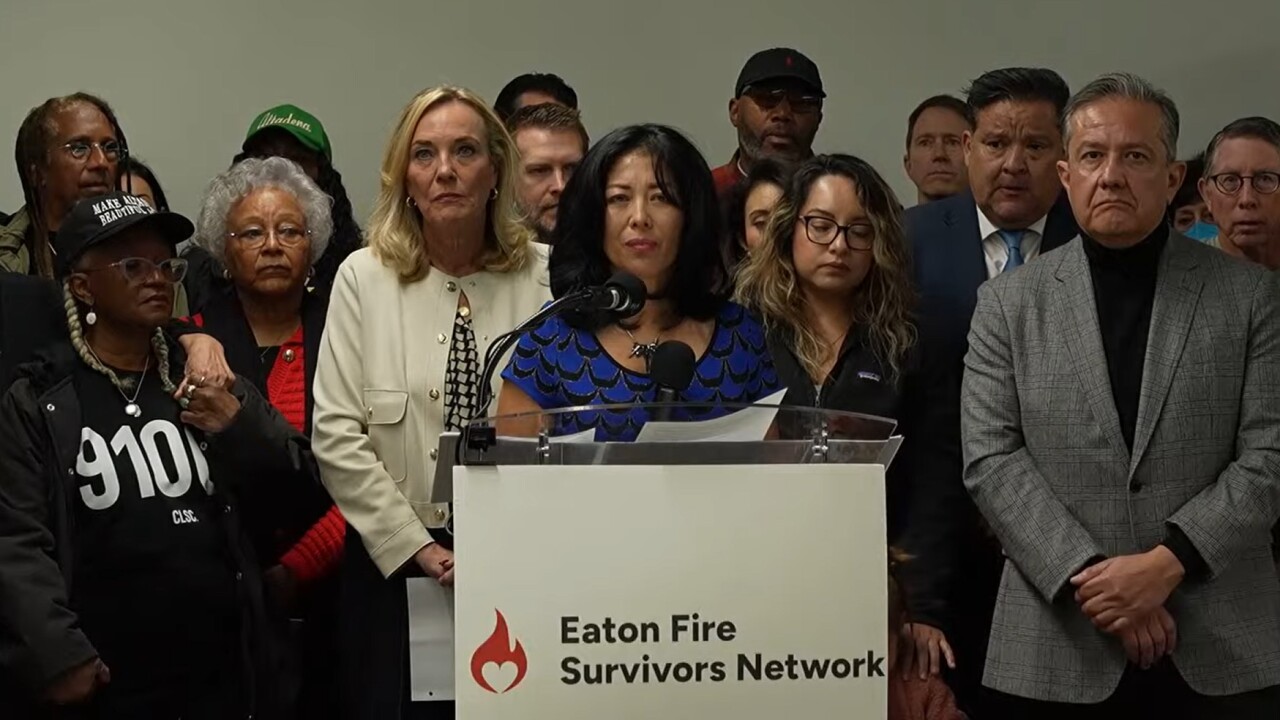

Insurers point to billions of dollars in claims paid, while wildfire survivors advocates say many haven't yet received what they are due.

January 8 -

New proposed legislation focuses on accelerating wildfire catastrophe claims payments, transparency of claims decisions, penalties for insurers delaying claims payments.

January 8 -

Gallagher's acquisitions of several insurance brokers gives the reinsurer more distribution for its capabilities and greater leveraging of data.

January 7 -

There were about 40 funding events in the insurtech sector in December 2025, according to a review by Digital Insurance.

January 7