-

Zurich Insurance Group AG has made a sweetened £8 billion ($11 billion) bid to buy Beazley Plc, an offer that's won the tentative approval of the UK insurer's board.

February 5 -

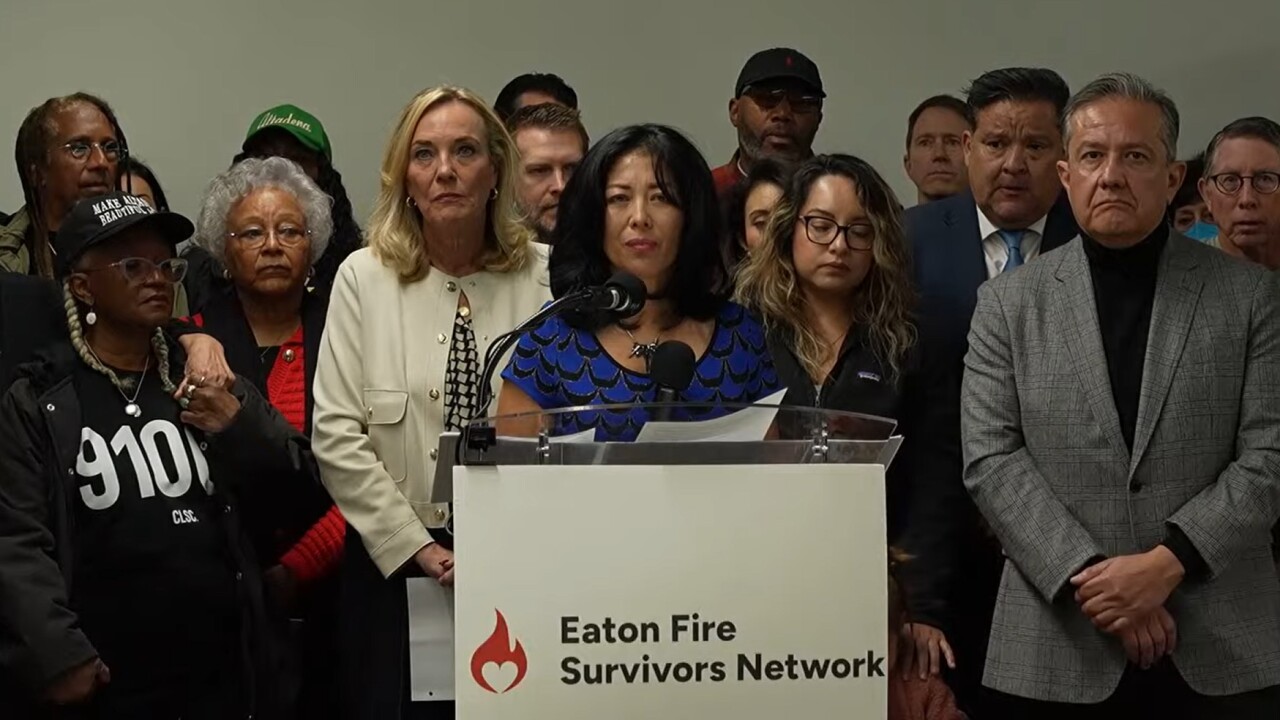

California assembly insurance committee chair and the state's insurance commissioner propose measure to improve claims handling, coverage options and transparency for wildfire survivors.

February 3 -

KPMG survey of insurance executives finds confidence in the industry's growth, seeing a need for technology advances and upskilling their workforces.

February 1 -

Insurance commissioner Ricardo Lara, responding on social media, said tariffs and ICE raids are making rebuilding more difficult. Advocates also point to federal disaster relief that has been held back.

January 28 -

Nearly 40,000 acres were burned in the Eaton and Palisades wildfires last January, killing at least 31 people and destroying 16,000 structures.

January 28 -

Without coverage, mortgage lenders could refuse to back home sales. Also, separate wildfire coverage could fall to the public sector.

January 27 -

A new analysis by RMI suggests that the current methods for counting damages from power outages means we are likely undercounting its impact.

January 27 -

U.S. homeowners are concerned about climate and insurance costs, according to Kin's Homeownership Trends Report.

January 25 -

Legislation cites non-renewals based on "inaccurate, outdated or misleading images."

January 21 -

Representatives of both insurers and policyholders point out multiple flaws in the new laws and additional proposed bills.

January 20 -

Digital Insurance contacted insurance professionals to comment on predictions for 2026 on various topics.

January 20 -

Representatives of both insurers and policyholders point out issues with market forces and challenges to addressing coverage costs.

January 19 -

Governor Ron DeSantis and state officials attribute lower premiums for the state's home insurer of last resort, and lower home and auto premiums overall, to the state's tort reform instituted in December 2023.

January 13 -

Insured losses for so-called non-peak perils — also sometimes referred to as secondary perils — reached a record $98 billion last year, Munich Re said in a report released on Tuesday.

January 13 -

Insurance carriers are working to improve digital quoting, according to the Keynova Q4 2025 Online Insurance Scorecard.

January 11 -

Insurers point to billions of dollars in claims paid, while wildfire survivors advocates say many haven't yet received what they are due.

January 8 -

New proposed legislation focuses on accelerating wildfire catastrophe claims payments, transparency of claims decisions, penalties for insurers delaying claims payments.

January 8 -

Gallagher's acquisitions of several insurance brokers gives the reinsurer more distribution for its capabilities and greater leveraging of data.

January 7 -

Increases ranging from 0.9% to 8.8% are necessary to maintain the insurer's past level of operating profit, according to its filings with state regulators.

December 29 -

Digital Insurance spoke with Nancy Clark, assistant vice president of regulatory strategy at Verisk, and a leader of the firm's Regulatory Data Exchange (RDeX) tool, about what the service offers to insurance carriers and regulators.

December 23