-

Digital Insurance contacted insurance professionals to comment on predictions for 2026 on various topics.

January 20 -

Representatives of both insurers and policyholders point out issues with market forces and challenges to addressing coverage costs.

January 19 -

Governor Ron DeSantis and state officials attribute lower premiums for the state's home insurer of last resort, and lower home and auto premiums overall, to the state's tort reform instituted in December 2023.

January 13 -

Insured losses for so-called non-peak perils — also sometimes referred to as secondary perils — reached a record $98 billion last year, Munich Re said in a report released on Tuesday.

January 13 -

Insurance carriers are working to improve digital quoting, according to the Keynova Q4 2025 Online Insurance Scorecard.

January 11 -

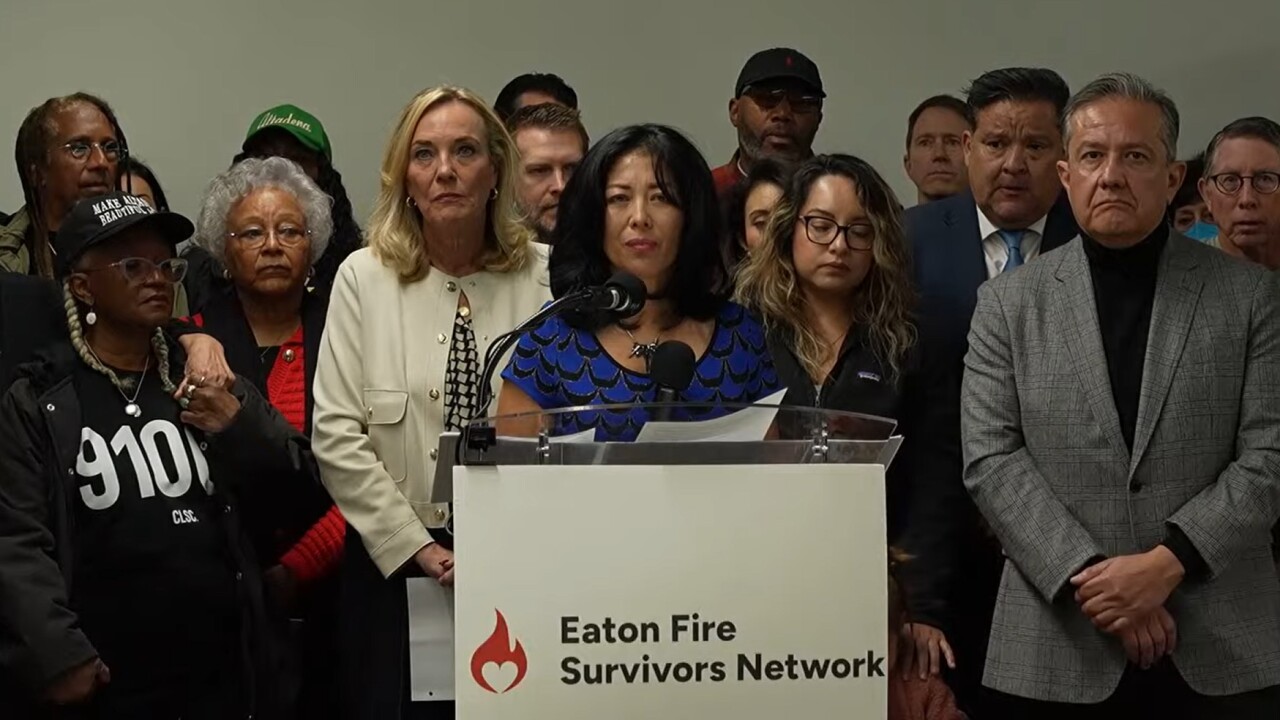

Insurers point to billions of dollars in claims paid, while wildfire survivors advocates say many haven't yet received what they are due.

January 8 -

New proposed legislation focuses on accelerating wildfire catastrophe claims payments, transparency of claims decisions, penalties for insurers delaying claims payments.

January 8 -

Gallagher's acquisitions of several insurance brokers gives the reinsurer more distribution for its capabilities and greater leveraging of data.

January 7 -

Increases ranging from 0.9% to 8.8% are necessary to maintain the insurer's past level of operating profit, according to its filings with state regulators.

December 29 -

Digital Insurance spoke with Nancy Clark, assistant vice president of regulatory strategy at Verisk, and a leader of the firm's Regulatory Data Exchange (RDeX) tool, about what the service offers to insurance carriers and regulators.

December 23 -

A California realtors group reportedly pressured the real estate site to stop displaying climate risk scores for homes. The private provider of the scores defended the quality of its models and ratings, while consumer advocates called for standardized, publicly available climate risk data about homes for buyers.

December 17 -

A paper published Tuesday in the Journal of Catastrophe Risk and Resilience estimates that Risk Rating 2.0, FEMA's 2021 update, resulted in up to 13% of those facing the highest premium increases dropping their policies.

December 17 -

Organization of state regulators, criticized for lack of disclosure of its previous collected data, promises to gather new information on losses, claims payments, policy premiums and mitigation discounts.

December 14 -

2025 Women in Insurance Leadership honoree Sarah Griffin, is SVP, product & underwriting at Nationwide.

December 14 -

Parametric providers can notify policyholders when an event triggers a claim, which can then be processed in days, helping customers get back to business more quickly.

December 11 Adaptive Insurance

Adaptive Insurance -

A senior advisor at NAIC, the association of state insurance regulators, told attendees of its fall meeting that the imminent FEMA Review Council report should answer questions about funding for disaster relief and flood insurance, as well as other related issues.

December 10 -

Experts suggest the industry is continuing to focus on innovation.

December 9 -

Under fire from consumer advocates after failures of new home insurers in the state, the ratings agency says its scores are meant to show an insurer's current health, and prospects for a maximum of one year. Reinsurance and the insurer's choice of policies being taken from the insurer of last resort can cause problems that surface later.

December 9 -

There were about 50 funding events in the insurtech sector in November 2025.

December 7 -

Amanda Smith is currently the chief product officer, home for Plymouth Rock Assurance.

December 3