-

Pet insurance needs to do more than reimburse. It must actively support pet owners in predicting problems and delivering real-time value.

June 12 EIS

EIS -

By leveraging vast amounts of data from multiple sources, insurers can analyze customer behaviors and risk factors in real time.

April 24FECUND Software Services. -

The trends revolve around speedier personalization, smarter automation and more efficient distribution.

March 10 Capgemini

Capgemini -

High-resolution, high-frequency imagery assists insurers with claims processing, underwriting and post-disaster property inspections.

November 8 Near Space Labs

Near Space Labs -

The partnerships with United Automobile Insurance Company and Citizens United Reciprocal Exchange come off the heels of Cloverleaf's investment into its suite of new AI-driven advanced analytics and data security technologies.

August 5 -

Many insurers have a traditional, albeit risk-averse, data mindset as evidenced by their reliance on traditional data and avoidance of emerging data sources.

March 23 IBM Global Insurance Industry

IBM Global Insurance Industry -

Progressive and others see opportunities to increase adoption as technology base grows.

August 18 -

The insurer partnered with Collective Medical and Mendocity on in- and out-patient capabilities.

May 18 -

Nearly six in ten consumers are open to sharing location data and lifestyle information in exchange for decreased pricing in financial products and services, according to Accenture.

March 20 -

Free2Move will use Trov’s Vehicle Activity API to adjust insurance premiums based on data received in real-time from all of its connected cars, based on each vehicle’s current risk state.

March 18 -

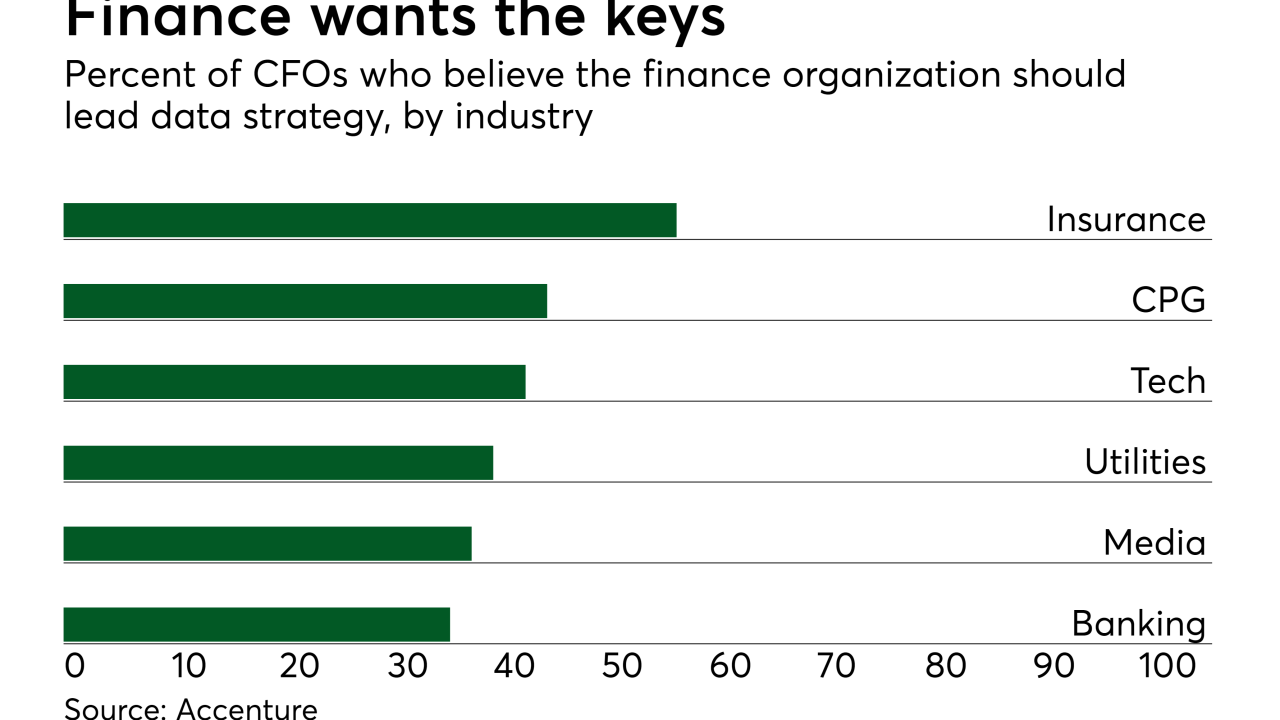

Leaders of the finance organizations want to be leaders in developing data and digital strategy, according to Accenture survey.

November 9 -

The increasing need for advanced solutions for real-time decisions on dynamic business events is accelerating the deployment of streaming analytics, a new report says.

September 7 -

Gains are especially being made near UC Berkeley, one of the major research universities in the Bay Area.

June 14 Novarica

Novarica -

It's crucial that insurers develop clear career-path options for these valuable staff, because there will be lots of competition for the skills.

March 30 Digital Insurance

Digital Insurance -

Led by chief digital transformation officer Todd Fancher, AmFam's innovation strategy will lean on small teams and focus on customer experience.

March 27 -

Several top colleges and universities are offering courses and concentrations in applying data to the sector.

February 26 -

Insurer's new self-service portal offers injured workers real-time connectivity to claims professionals and access to a network of healthcare providers.

November 30 -

With today’s digital tools and platforms, the technology can be applied to various aspects of the insurance value chain.

November 6

-

Individual state guidelines, dating back as far as the 1800s, cater to old paper-driven market, not a digital world where insurtechs produce data in real-time, says former NAIC president.

November 2 -

"Smart contracts" provide a shared view of policy data in real-time while helping fight fraud.

June 16