-

When AI is simply layered on top of policy-centric platforms, batch-based processes, and siloed data models, it inherits their limitations.

February 5 EIS Group

EIS Group -

UnitedHealthcare's Flexwork program offers hourly employees affordable health coverage, including dental, vision and virtual care.

February 5 -

Insurers learned that 2025 was about regaining balance and 2026 will be about redefining value for customers with better data, tools and insights.

February 4 Plymouth Rock Home Assurance Corporation

Plymouth Rock Home Assurance Corporation -

AI is reshaping how claims are handled, how repairs are performed, and how teams deliver faster and more connected experiences across the auto claims ecosystem.

February 4 CCC Intelligent Solutions

CCC Intelligent Solutions -

Digital Insurance spoke with Greg Chandler, executive VP for IT at the insurer, which specializes in workplace benefits, about how the company began implementing AI, how its use of AI has evolved, and what's next.

February 4 -

A collection of stories related to the climate crisis from 2025.

February 3 -

Insurance companies need more reliable, bottom-up data and more strategic technology partnerships.

February 3 Spektrum Labs

Spektrum Labs -

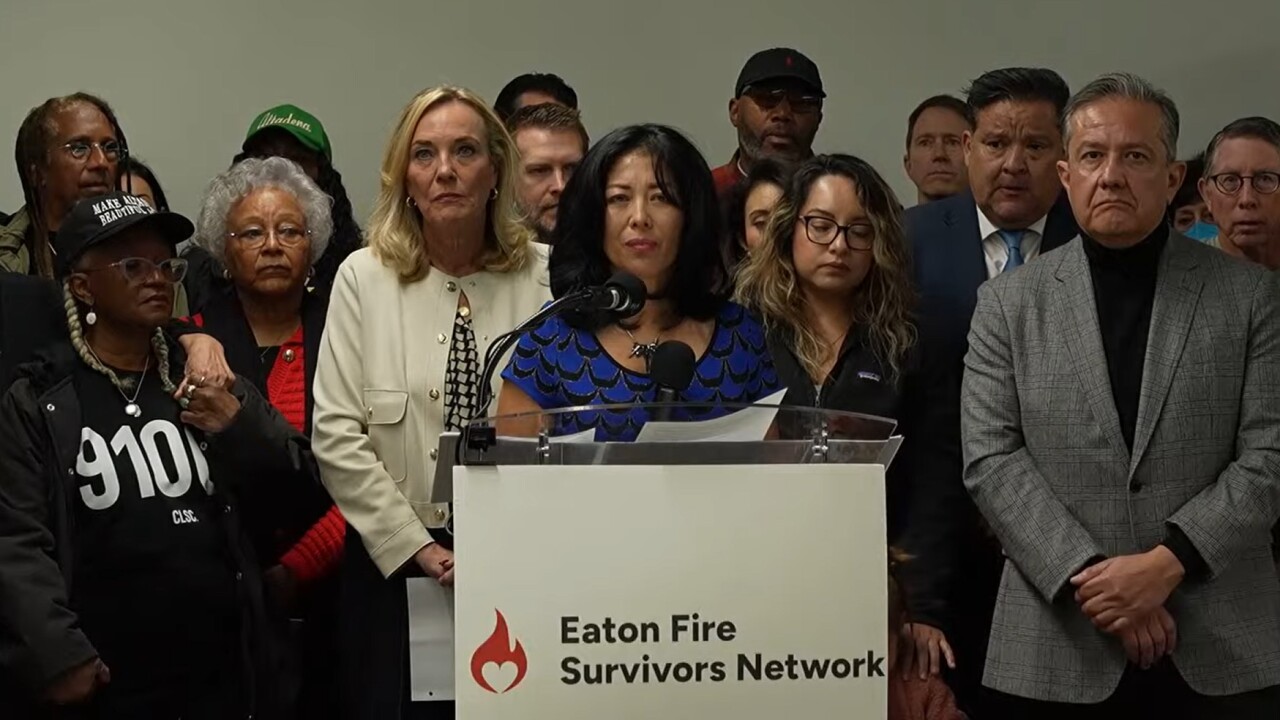

California assembly insurance committee chair and the state's insurance commissioner propose measure to improve claims handling, coverage options and transparency for wildfire survivors.

February 3 -

AI holds enormous potential for small businesses, providing tools that can empower them to do more with less.

February 2 Cooperhawk Business Brokers

Cooperhawk Business Brokers -

The industry's use of the technology is moving on from extracting insights from data, toward supporting or making underwriting and operational decisions, Datos Insights analysts say.

February 2 -

KPMG survey of insurance executives finds confidence in the industry's growth, seeing a need for technology advances and upskilling their workforces.

February 1 -

Emerging AI capabilities give agencies a clearer, more dynamic view of their entire book of business including underwriting, renewal and service workflows

February 1 Applied Systems

Applied Systems -

Tracking fraud, waste and abuse in healthcare is a challenge, but AI is helping insurers identify it sooner.

January 29 Sigma Software

Sigma Software -

Jonathan Jackson, CEO of Previsico, shared insights into the company.

January 29 -

Insurance commissioner Ricardo Lara, responding on social media, said tariffs and ICE raids are making rebuilding more difficult. Advocates also point to federal disaster relief that has been held back.

January 28 -

Exec from Crum & Foster explains how the organization has seen tremendous success by covering travel protection for their own employees.

January 28 -

Rates actually declined or remained flat over a two-year period in 15 states, including Florida, with natural disasters and tariffs affecting 2026's movements.

January 27 -

Without coverage, mortgage lenders could refuse to back home sales. Also, separate wildfire coverage could fall to the public sector.

January 27 -

The top two municipal bond insurers wrapped over $41.828 billion in 2025, up from $41.166 billion in 2024, data shows.

January 27 -

Gina Downs does the blocking and tackling for retired athletes and their families when it comes to accessing medical and behavioral healthcare.

January 27 -

A mortgage insurance premium deduction in Maine would come after the reintroduction of a similar federal policy, which took effect with the 2026 tax year.

January 27 -

A collection of stories related to artificial intelligence and its impact on the insurance industry from 2025.

January 26 -

The insurance industry must discard outdated models and embrace new skillsets to survive.

January 26 Simply Business US

Simply Business US -

Joe Zuk, operating partner at Altamont Capital Partners, spoke to Digital Insurance about how insurers should apply AI to managing data for underwriting, and to analyzing events.

January 25 -

U.S. homeowners are concerned about climate and insurance costs, according to Kin's Homeownership Trends Report.

January 25 -

AIG CEO Peter Zaffino to transition to executive chair and Eric Andersen named president and CEO-elect; InnSure launches climate risk incubator platform, plus more insurtech news.

January 22 -

EY financial analysis reveals insurance deals across Europe, North America, Asia and Oceania's major financial markets.

January 21 -

Legislation cites non-renewals based on "inaccurate, outdated or misleading images."

January 21 -

Capgemini's Samantha Chow looks at the future of life insurance and how the customer experience and coverage itself will continue to evolve.

January 21 -

Representatives of both insurers and policyholders point out multiple flaws in the new laws and additional proposed bills.

January 20 -

Digital Insurance contacted insurance professionals to comment on predictions for 2026 on various topics.

January 20 -

Representatives of both insurers and policyholders point out issues with market forces and challenges to addressing coverage costs.

January 19 -

Digital Insurance contacted insurance professionals to comment on the climate crisis and natural disasters.

January 19 -

AI is transforming underwriting and helping to automate different aspects while improving the customer and agent experience.

January 18 Damco Solutions

Damco Solutions -

Fathom, acquired by Swiss Re in December 2023, provides flood hazard and terrain datasets that capture extreme outcomes.

January 15 -

The Hartford is opening a technology hub in Columbus, Ohio.

January 15 -

The most impactful data today is clean, structured, operational data collected across the entire policy lifecycle.

January 14 Novidea

Novidea -

Traditional factors like artificial intelligence, cybersecurity and business interruption highlight what's on business executives' risk radar in 2026.

January 14 -

Governor Ron DeSantis and state officials attribute lower premiums for the state's home insurer of last resort, and lower home and auto premiums overall, to the state's tort reform instituted in December 2023.

January 13 -

Swiss Re's Liability Excess Inflation report outlines the rising severity of liability claims, revealing a 7% growth in the United States during 2024.

January 12 -

AI impersonation fraud and attempts involving deepfakes have surged by more than 2100% over the last three years.

January 12 Input 1

Input 1 -

Kyle Busch's lawsuit against Pacific Life and his former insurance agent provides a window into potential issues around complexity, suitability and more in indexed universal life policies.

January 12 -

Digital Insurance contacted insurance professionals to comment on workers' compensation insurance.

January 11 -

Insurance carriers are working to improve digital quoting, according to the Keynova Q4 2025 Online Insurance Scorecard.

January 11 -

Insurers point to billions of dollars in claims paid, while wildfire survivors advocates say many haven't yet received what they are due.

January 8 -

New proposed legislation focuses on accelerating wildfire catastrophe claims payments, transparency of claims decisions, penalties for insurers delaying claims payments.

January 8 -

Gallagher's acquisitions of several insurance brokers gives the reinsurer more distribution for its capabilities and greater leveraging of data.

January 7 -

There were about 40 funding events in the insurtech sector in December 2025, according to a review by Digital Insurance.

January 7 -

Bill Martin, president and CEO of Plymouth Rock Assurance, addresses why legacy insurers are the best insurtechs.

January 7 -

Profiles of the 16 honorees for the 2025 Women in Insurance Leadership program.

January 6 -

Used correctly, AI can help insurers move faster, identify risk more accurately, and reduce costs without replacing human expertise.

January 6

-

As Washington revisits the tax-favored status of health benefits, a longtime policy expert explains why replacing group plans could cost far more.

January 6 -

A vertical-specific AI can digitize the contextual judgment of retiring experts, helping staff to access "word-of-mouth" wisdom instantly in the correct context.

January 5 Outmarket

Outmarket -

AI will move from the margins and into the fabric of insurance, redefining how carriers do business and streamlining operations for efficiency while optimizing the customer experience.

January 5 INSTANDA

INSTANDA -

The impact of extreme weather remains top of mind for many, with a majority of homeowners citing it as a factor behind purchase or relocation considerations.

January 5 -

Changing communication methods like the use of emojis present a growing compliance risk in regulated industries where interactions are subject to scrutiny.

January 4 Smarsh

Smarsh -

Experts discuss what new and emerging risks to look out for in 2026.

January 4 -

AI agents can reason through complex questions, understand intent, communicate naturally, and handle tasks that used to require a person on the other end of a call.

January 1 ASAPP

ASAPP -

In most agencies, 80% of revenue is generated by only 20% of their accounts, meaning that 80% of an agency's customer base is responsible for only 20% of its revenue.

January 1 ReSource Pro

ReSource Pro -

Insurers can transform AI spending into intelligent capacity investment through several practical steps and strategies.

December 31 LingXi Technology

LingXi Technology -

Enterprises are adopting agentic AI that plans and executes on its own while compounding errors, accountability gaps and cyber risk. Clear safeguards and auditability are critical.

December 30 Information Security Forum

Information Security Forum -

As fraudulent claims evolve, so do the defenses against them. Here are four common fraud claims and how to combat them.

December 30 Pennsylvania Lumbermens Mutual Insurance Company (PLM).

Pennsylvania Lumbermens Mutual Insurance Company (PLM). -

CannaLnx, a new digital health platform, connects doctors, insurers and dispensaries as employers begin adding reimbursable medical cannabis to workplace benefit plans.

December 30 -

Increases ranging from 0.9% to 8.8% are necessary to maintain the insurer's past level of operating profit, according to its filings with state regulators.

December 29 -

AI may be accelerating and scaling digital crime, but the same underlying technology is poised to advance cybersecurity intelligence and strengthen defenses.

December 29 TransUnion

TransUnion -

Successful risk management pairs AI-driven efficiency with human insight and aligns digital initiatives with strategic business goals.

December 29 CGI

CGI -

Tresa Stephens, North America Allianz commercial regional head of cyber, tech and media, holds over a decade of experience in delivering specialized cyber, tech and professional liability solutions.

December 28 -

New leader of Nationwide Securities and Beazley's head of digital follow underwriting, plus more insurance news.

December 28 -

How to include empathy and prototyping into change management.

December 28 Crum & Forster

Crum & Forster -

Insurance is constantly evolving and now the focus is on returning to the fundamentals and preparing for future growth.

December 24 Vitesse

Vitesse -

When embedded within a case management framework, Agentic AI can detect subtle anomalies, highlight inconsistencies, and surface patterns traditional systems miss.

December 24 Flowable

Flowable -

Digital Insurance spoke with Nancy Clark, assistant vice president of regulatory strategy at Verisk, and a leader of the firm's Regulatory Data Exchange (RDeX) tool, about what the service offers to insurance carriers and regulators.

December 23 -

Sarah Murrow, president and CEO of Allianz Trade in Americas, shares her career journey in the insurance industry and her approach to acting as an effective leader to a multi-national business.

December 23 -

Insurance professionals share predictions related to artificial intelligence and insurtech for 2026.

December 23 -

Three things brokers can do to retain and grow their client base through M&A transitions.

December 22 Beneration

Beneration -

Overall satisfaction is highest when customers receive status updates from mobile apps, according to the J.D. Power's 2025 U.S. Claims Digital Experience Study.

December 22 -

According to Swiss Re, 83% of losses were driven by the United States' LA wildfires and severe convective storms.

December 21 -

Members of the association of state insurance regulators began another revision of its proposed AI Systems Evaluation Tool, a proposal attracting skepticism from insurers and the insurtech companies who serve them.

December 21 -

The winner, Manasa Ramaka, a University of Connecticut graduate, shares how she used LLMs in her approach to pet insurance data standardization.

December 18 -

It's important that managing data enables speed, accountability, and trust at scale.

December 18 Xceedance

Xceedance -

A California realtors group reportedly pressured the real estate site to stop displaying climate risk scores for homes. The private provider of the scores defended the quality of its models and ratings, while consumer advocates called for standardized, publicly available climate risk data about homes for buyers.

December 17 -

A better approach is to offer communication options intentionally, not reactively.

December 17 Hi Marley

Hi Marley -

The 2025 Women in Insurance Leadership Lifetime Award honoree values authenticity, confidence and vision in her teams, while encouraging leadership and accountability.

December 16 -

What's ahead for auto insurance in 2026.

December 16 -

WIL 2025 honoree believes knowing the insurance products is a good foundation for leading her team in its work on the insurer's Marketplace platform.

December 16 -

Craig Kurtzweil, chief data and analytics officer for UnitedHealthcare's commercial business, shared insights related to how the company is deploying technology.

December 15 -

Nationwide announced Michael Carrel as its chief technology officer.

December 15 -

The new solution includes reimbursement opportunities as well as access to personal coaching if employees are victims of fraud.

December 15 -

Organization of state regulators, criticized for lack of disclosure of its previous collected data, promises to gather new information on losses, claims payments, policy premiums and mitigation discounts.

December 14 -

2025 Women in Insurance Leadership honoree Sarah Griffin, is SVP, product & underwriting at Nationwide.

December 14 -

Parametric providers can notify policyholders when an event triggers a claim, which can then be processed in days, helping customers get back to business more quickly.

December 11 Adaptive Insurance

Adaptive Insurance -

As more insurers tie credits to connected technologies, monitoring will become a basic expectation rather than an added feature.

December 11 Beagle Services

Beagle Services -

The changing climate is increasing insurance rates for residents and cities and lowering property values in areas that face more frequent and intense disasters.

December 11 -

Successful leadership requires authenticity, accountability and the willingness to go pursue new opportunities when they arise.

December 10 -

The adoption of AI requires buy-in from all departments and levels, and is a tool that can help insurers manage vast amounts of data more effectively.

December 10 NFP

NFP -

Linda Fallon is a 2025 Women in Insurance Leadership honoree, she is division president, consumer.

December 10 -

A senior advisor at NAIC, the association of state insurance regulators, told attendees of its fall meeting that the imminent FEMA Review Council report should answer questions about funding for disaster relief and flood insurance, as well as other related issues.

December 10 -

Experts suggest the industry is continuing to focus on innovation.

December 9 -

Whisker Labs expands into water loss and Everest leadership appointments, plus more insurtech news

December 9 -

Under fire from consumer advocates after failures of new home insurers in the state, the ratings agency says its scores are meant to show an insurer's current health, and prospects for a maximum of one year. Reinsurance and the insurer's choice of policies being taken from the insurer of last resort can cause problems that surface later.

December 9